Together with the financial boutique Brevalia AG we launch the first reputation-based investment solution in Switzerland.

All relevant information on the certificate can be found at: https://brevalia.ch/amc-reputation

More about the concept of reputation-based investment strategies at: https://commslab.com/reputation-based-asset-allocation/

Reputation allows a differentiation between companies that permanently fulfil publicly expressed expectations and those with negative expectations. In addition to economic expectations, Reputation also reflects the social contribution and the uniqueness of the company.

Reputation is tangible

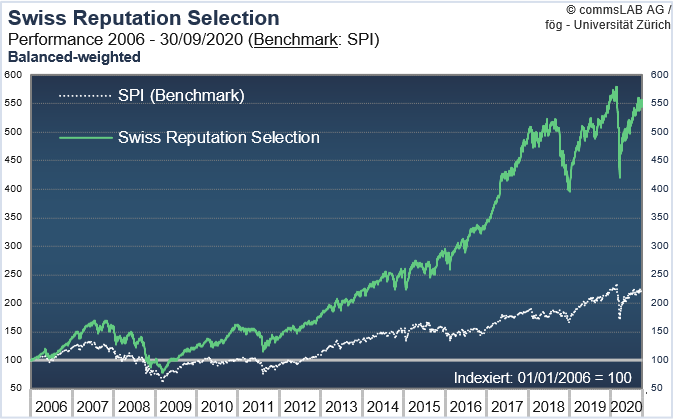

The SRI® developed by commsLAB and the fög Research Centre for Public and Society at the University of Zurich serves to model the historically grown reputation anchored in public memory and allows the presentation of long-term developments. Accordingly, the investment strategy of the certificate is based on the contextual analysis, structuring and evaluation of reputation-relevant, publicly available information on Swiss listed companies with a strong resonance. The result is a unique and completely independent weighting strategy that reflects the long-term positive reputation effects of companies via overweights in the active investment strategy.

Selection criteria

Prerequisites for a reputation rating are the sufficient presence of the company in publicly available sources, a market capitalisation of at least CHF 200 million and an average daily turnover of at least CHF 2 million.

Swiss Reputation: Relevance for Switzerland as a business location

The investment solution rewards companies that are publicly regarded as particularly trustworthy and sustainable for Switzerland as a business location. It is designed in particular for investors who are looking for promising investment strategies for stock market companies with relevance for the Swiss economy.