Swiss Reputation Selection AMC

The certificate issued by Zürcher Kantonalbank under the name “ZKB Tracker Certificate Dynamic on Swiss Reputation Selection Basket” identifies the 20 best-reputed companies out of around 100 companies listed on the Swiss stock exchange and ranks them by reputation. The aim is to generate a sustainable excess return over the benchmark SPI (Swiss Performance Index). Stock selection and weighting are based on the Sedimented Reputation Index® (SRI®) developed by commsLAB AG and the fög – University of Zurich.

All relevant information on the certificate can be found under the following link: https://brevalia.ch/amc-reputation

Successful stock selection

Selection criteria

Reputation is tangible

Relevance for Swiss business location

Reputation as an investment criterion

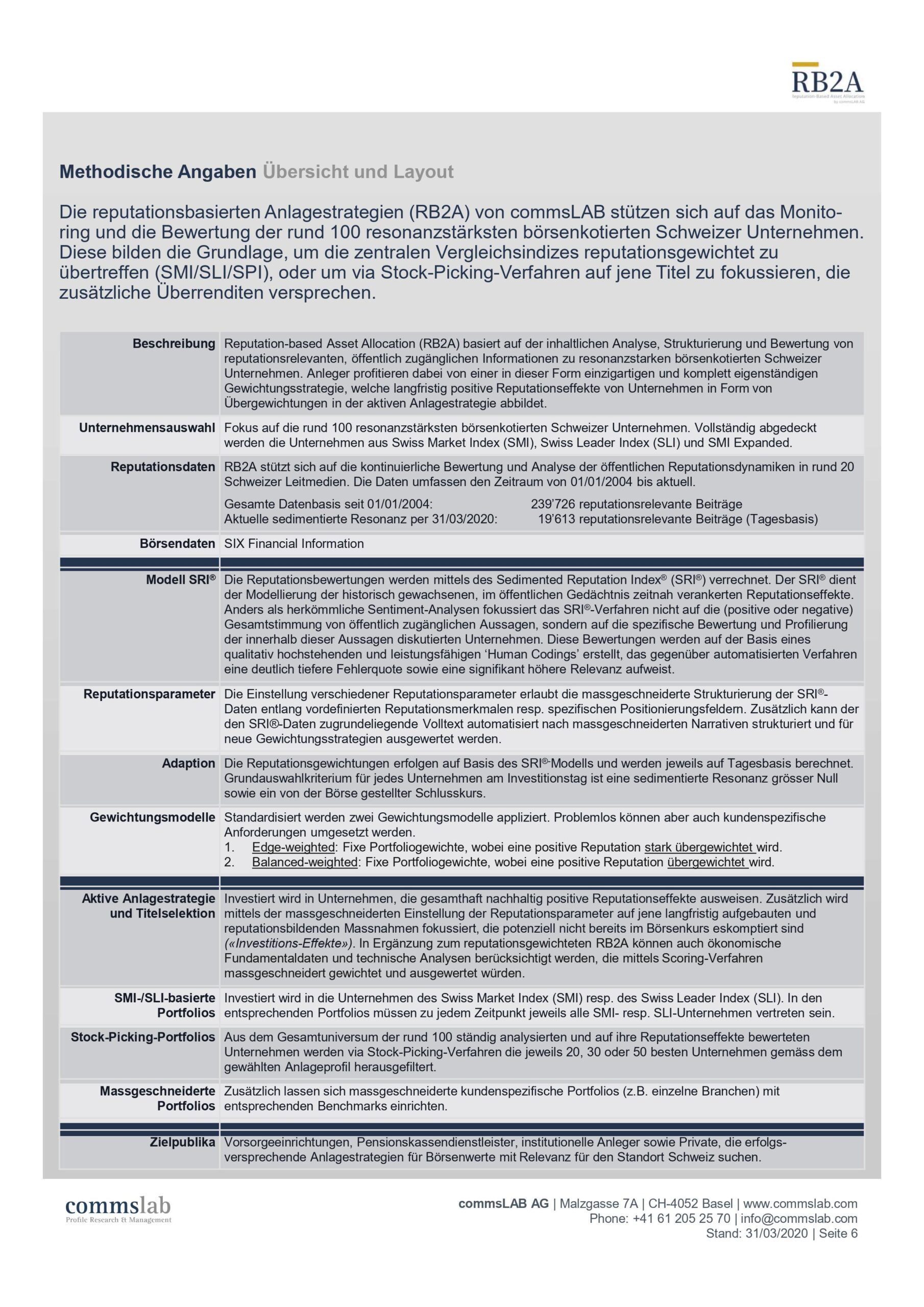

The benchmark-oriented investment approach “Reputation-based Asset Allocation” (RB2A) is based on the contextual analysis, structuring and evaluation of reputation-relevant, publicly available information on Swiss listed companies with a strong resonance.

The result is a unique and completely stand-alone weighting strategy that reflects long-term positive reputation effects of companies via overweights in the active investment strategy.

Value adding factor

Investment focus

Excess returns

Reputation premium

Execution and investment profiles

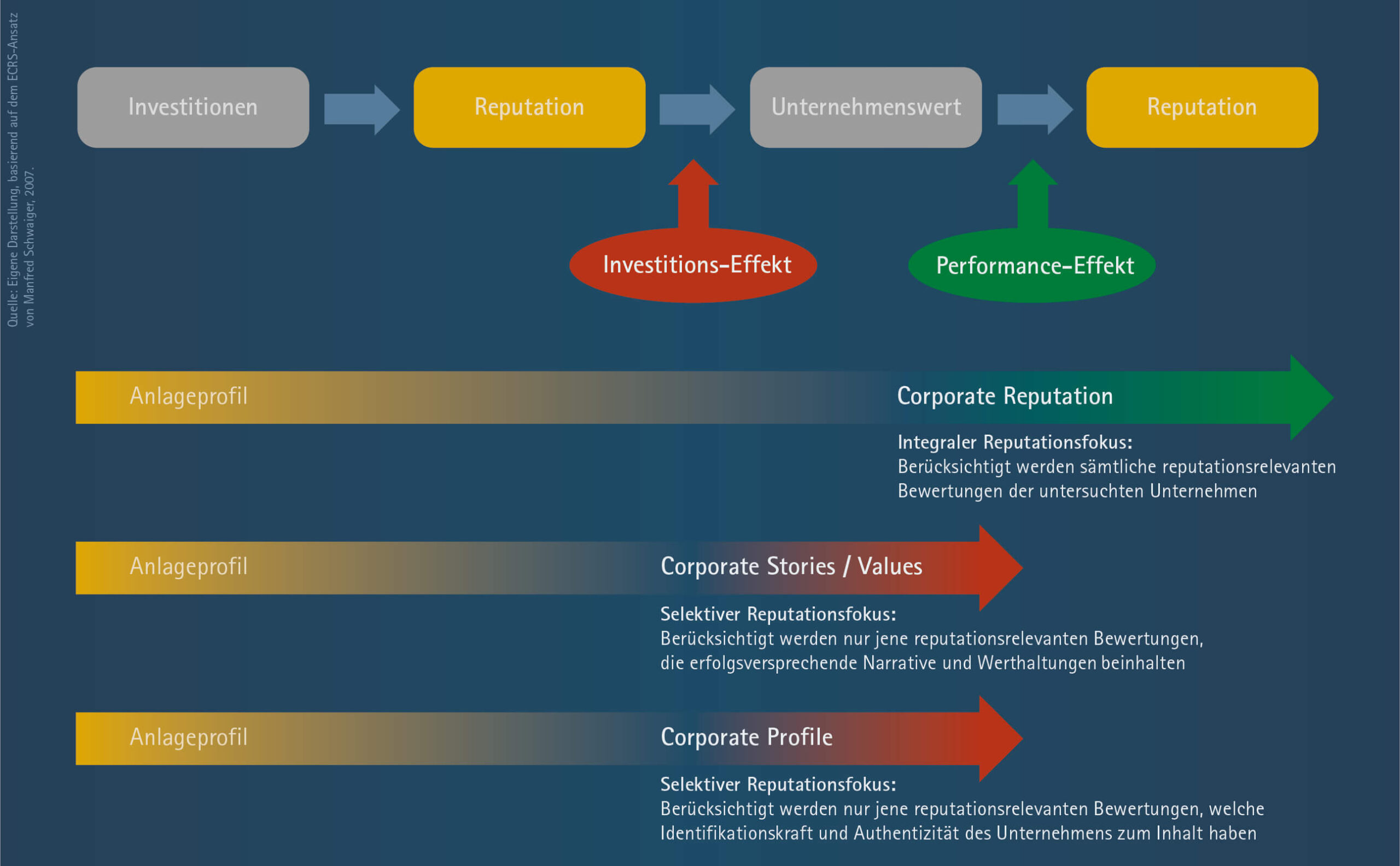

Investment effect

Shares with an above-average reputation therefore generate significant excess returns.

Performance effect

An improvement in financial performance therefore leads to an improvement in reputation, regardless of the starting level.

Reputation-based Stock Selection

The reputation-based investment strategies of commsLAB AG invest in companies that have sustained positive reputation effects overall. As a significant value-adding factor, reputation is therefore systematically used as an investment criterion, with the aim of achieving long-term excess returns over traditional portfolio approaches.

Methodological information

commsLAB’s reputation-based investment strategies are based on the monitoring and assessment of around 100 of the most responsive exchange-listed Swiss companies. They provide the basis for outperforming the major benchmark indices on a reputation-weighted basis (SMI/SLI/SPI), or for focusing via stock-picking procedures on those securities that promise additional excess returns.

Learn more:

Learn more:

RB2A Investment Approaches

Investment approach – Swiss Reputation Selection (Benchmark SPI)

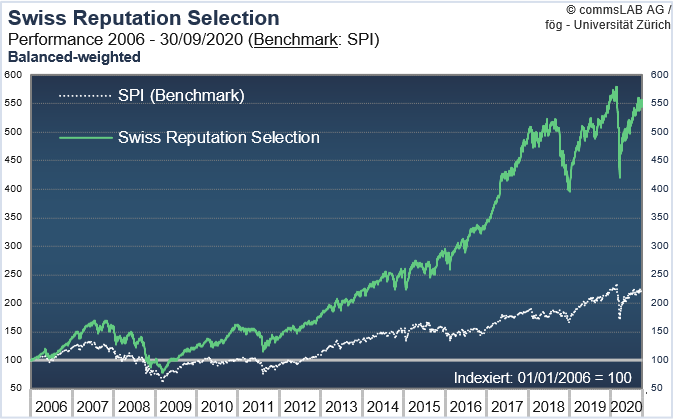

The investment approach “Swiss Reputation Selection” aims to identify the 20 best-reputated companies out of around 100 companies listed on the Swiss stock exchange and to rank them in a reputation-weighted manner. Weighting criterion is the reputation (SRI®) of the individual companies. The chart shows the historical simulation of the investment approach. → Learn more

Details investment approach

| Basis | Reputation data commsLAB/fög-UZH. Stock price information from SIX Financial Information |

| Distributions | None. Net dividends (65%) are reinvested |

| Stock selection | The prerequisites for reputation coding by commsLAB are: Sufficient presence of the company in publicly available sources, a market capitalization of at least CHF 200 million and an average daily trading volume of at least CHF 2 million. At any time, 20 companies are represented in the portfolio (stock picking) |

| Selection criterion | Sedimented resonance and listed on the Swiss stock exchange |

| Frequency | Monthly adjustment of weightings |

| Weighting | Balanced-weighted: Fixed portfolio weightings, with an overweight of positive reputation. See ‘Current positions’ for effective weights. |